Do you need a car for yourself or for your family? Having a car nowadays is part of the necessity especially when the purpose is for cutting short the usual long travels, hence for leisure when you desire to take your family into an out of town or city vacation trips. Indeed, it is more convenient to have your own car when your workplace is far from home. The necessity of purchasing a car have increased for reasons of making the travel more easy and less time consuming.

Unfortunately, not everyone have the easy access or instant cash. Purchasing the car you desire is a dream come true, but the trouble comes if you have no cash to buy the full price. Auto loan companies now come to the picture to finance anyone who is interested to buy a new car. Financing institutions or banks now offer a variety of choices giving the applicant the flexibility of selecting the auto loan type which is convenient for him.

When applying for a car loan, there are several requisites you need to pass upon in order that the approval would be faster and giving you the convenience of driving your dream car.

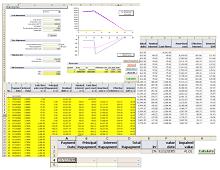

One is down payment, when you have a financial interest on a certain vehicle, some auto lenders will require you to shell out a certain initial payment, and this would show that aside from your interest on the vehicle, it is less likely that you will default on the loan. Another requirement is having a zero credit report. Many auto lenders would require you to show them your credit, hence make sure you have no credit so that you can possibly get good deals. Moreover, make sure to consider with your budget and ability to pay the loan. Of course, you would not want to face any trouble eventually when you can’t afford paying the interest. Keeping in mind your budget will save you from such in the long run. It is very difficult to be impulsive with applying auto loan without taking note of any budget plan. The tendency is that you may put yourself into a loophole when unable to pay your loan and its interest.

Next thing to keep in mind after budgeting is to choose the type of car that you desire, especially thinking of the specifications that fits you. After doing so, the auto lenders will provide you with choices and calculations.

While it is true that auto loan is the best option when buying your dream car, it is still a priority to bear in mind your financial situation. If you are confident that you can afford it, then go for it.